Wake County Tax Listing

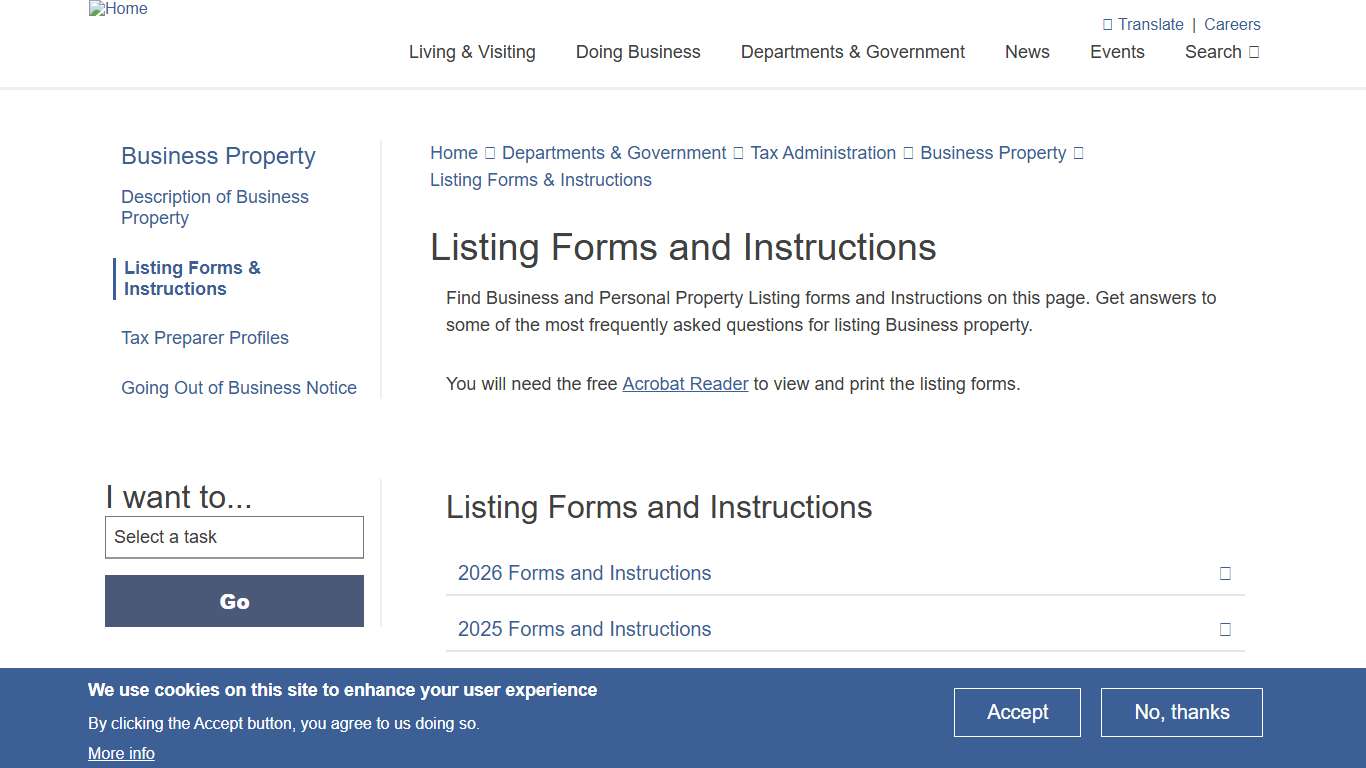

Listing Forms and Instructions Wake County Government

Find Business and Personal Property Listing forms and Instructions on this page. Get answers to some of the most frequently asked questions for listing Business property. Listing Forms and Instructions 2026 Forms and Instructions 2025 Forms and Instructions 2024 Forms and Instructions 2023 Forms and Instructions 2022 Forms and Instructions 2021 Forms and Instructions 2020 Forms and Instructions Want to file online?

https://www.wake.gov/departments-government/tax-administration/business-property/listing-forms-and-instructions

2026 Individual Property Listing Form Web- Wake County

Wake County Tax Administration. 2026 INDIVIDUAL PROPERTY LISTING. 301 S. McDowell Street, Suite 3800. Due by: January 31, 2026. P.O. Box 2331.

https://s3.us-west-1.amazonaws.com/wakegov.com.if-us-west-1/s3fs-public/documents/2025-12/2026%20Individual%20Property%20Listing%20Form%20Web.pdfBusiness Property Wake County Government

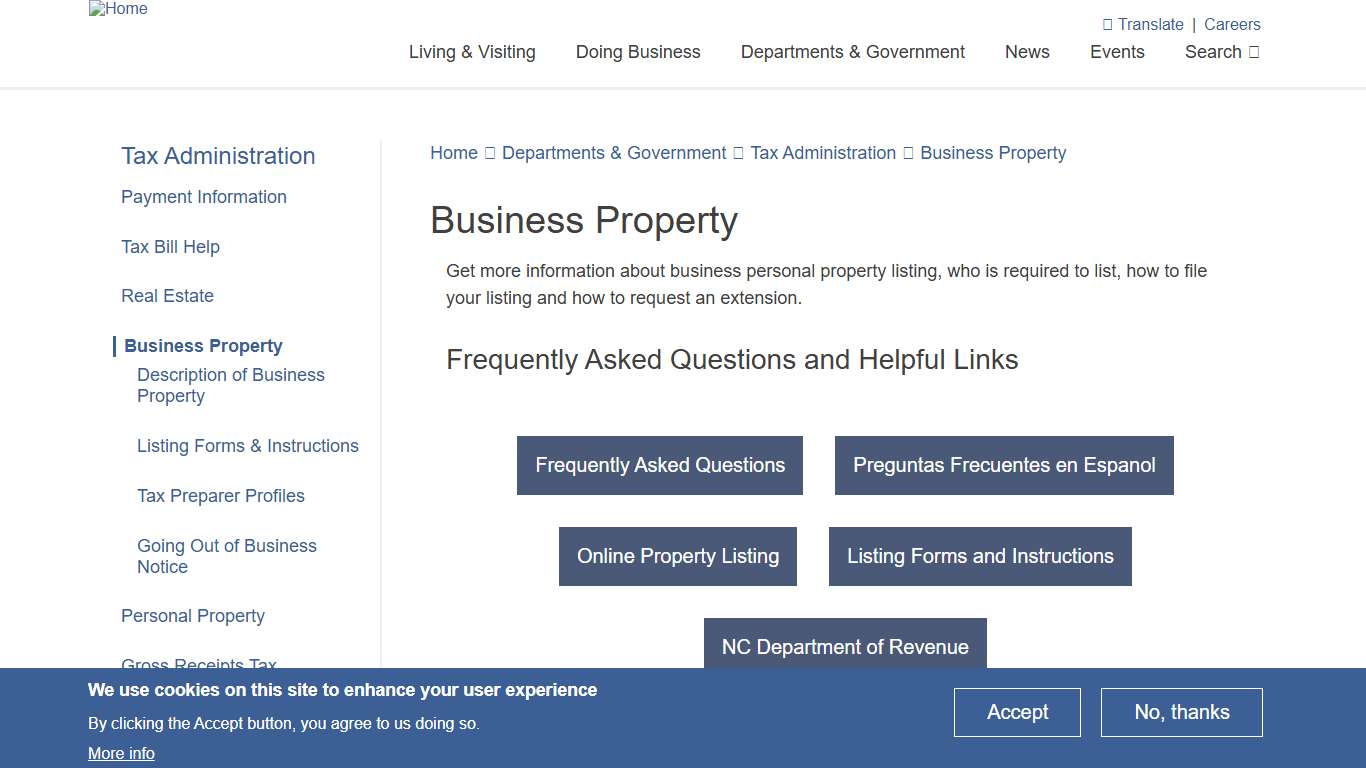

Get more information about business personal property listing, who is required to list, how to file your listing and how to request an extension. Business Personal Property and Listing Information Examples of business personal property include: - Computer and office equipment - Supplies - Materials - Machinery - Farm equipment - Leasehold improvements Further clarification on business personal property can be found on our description of busine...

https://www.wake.gov/departments-government/tax-administration/business-property

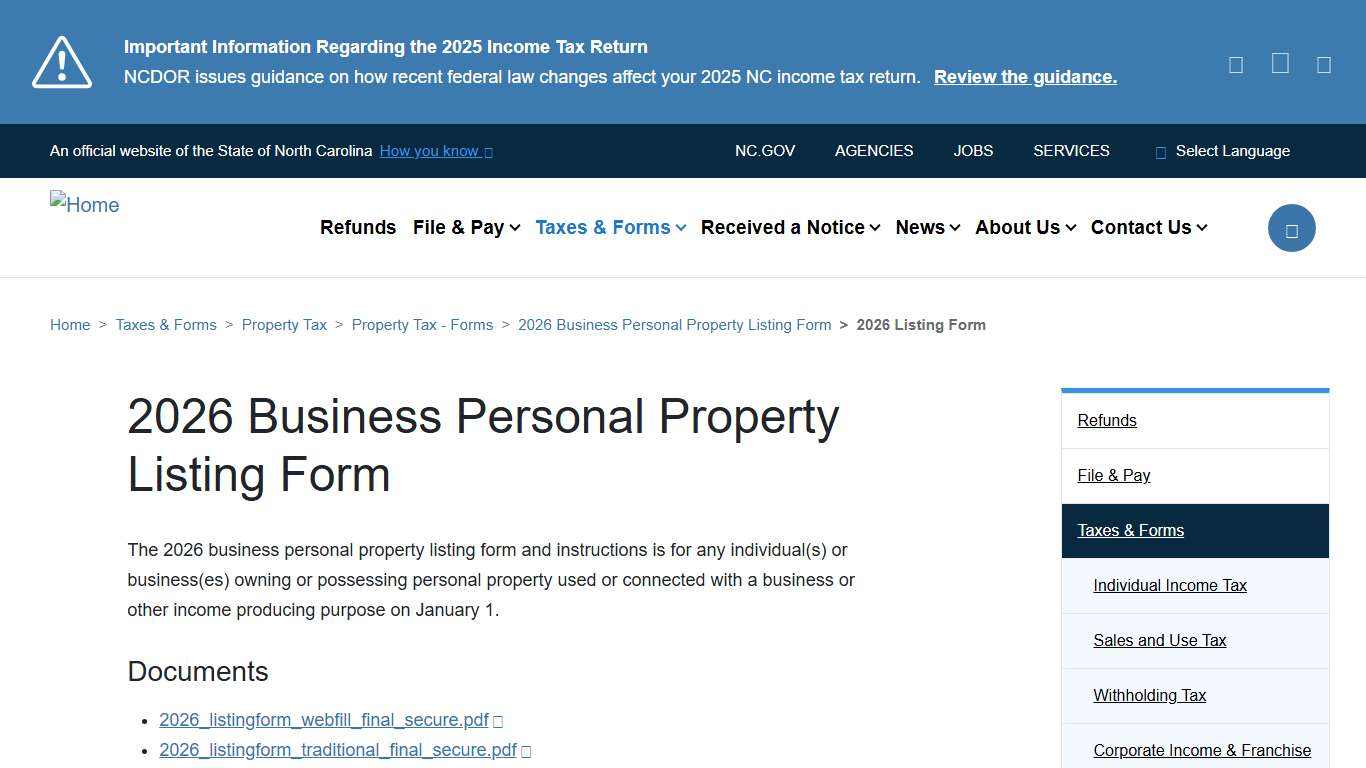

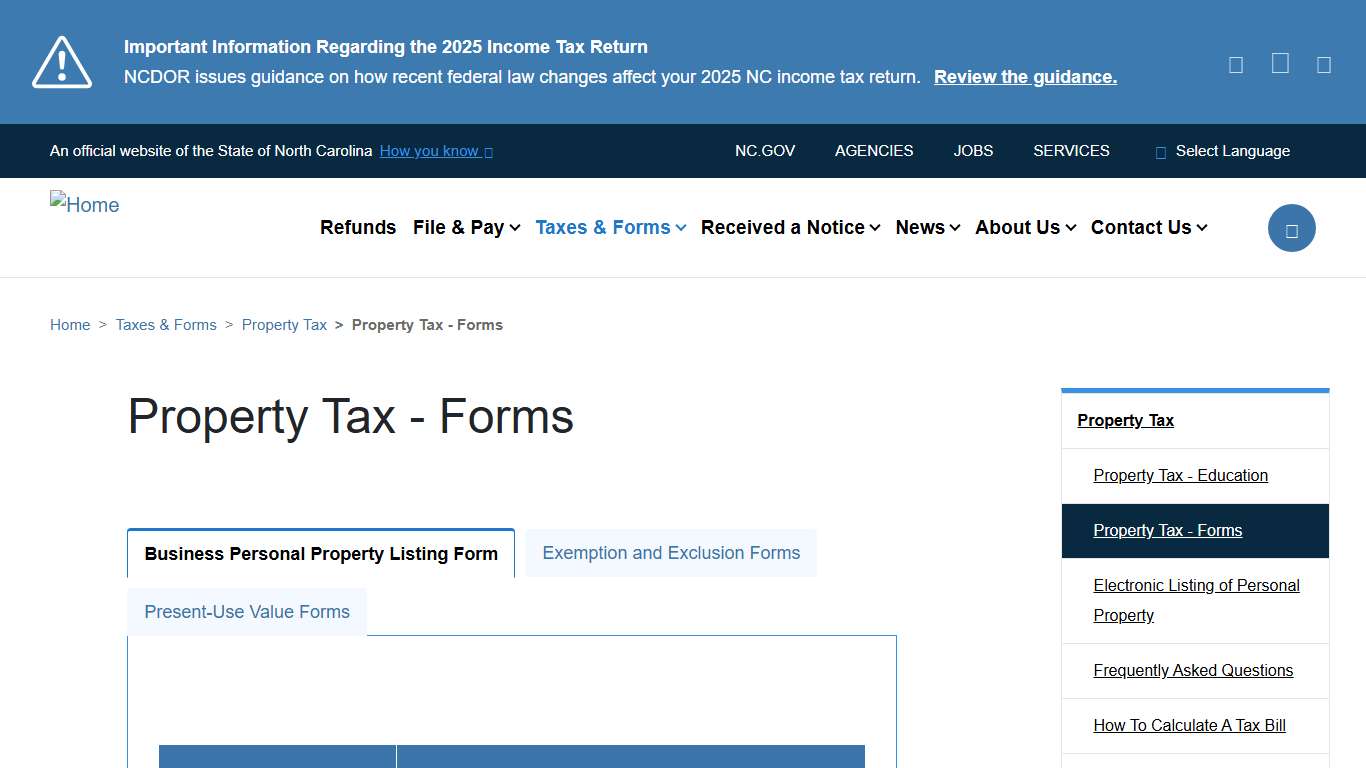

2026 Business Personal Property Listing Form NCDOR

The 2026 business personal property listing form and instructions is for any individual(s) or business(es) owning or possessing personal property used or connected with a business or other income producing purpose on January 1. A new tax on alternative nicotine products will also be imposed.

https://www.ncdor.gov/taxes-forms/property-tax/property-tax-forms/2026-business-personal-property-listing-form/2026-business-personal-property-listing-form

2026 Business Property Listing Instructions

If submitting by mail, the listing must be postmarked by April 15, 2026. Listings postmarked after April 15, 2026, will only be considered timely if filed.

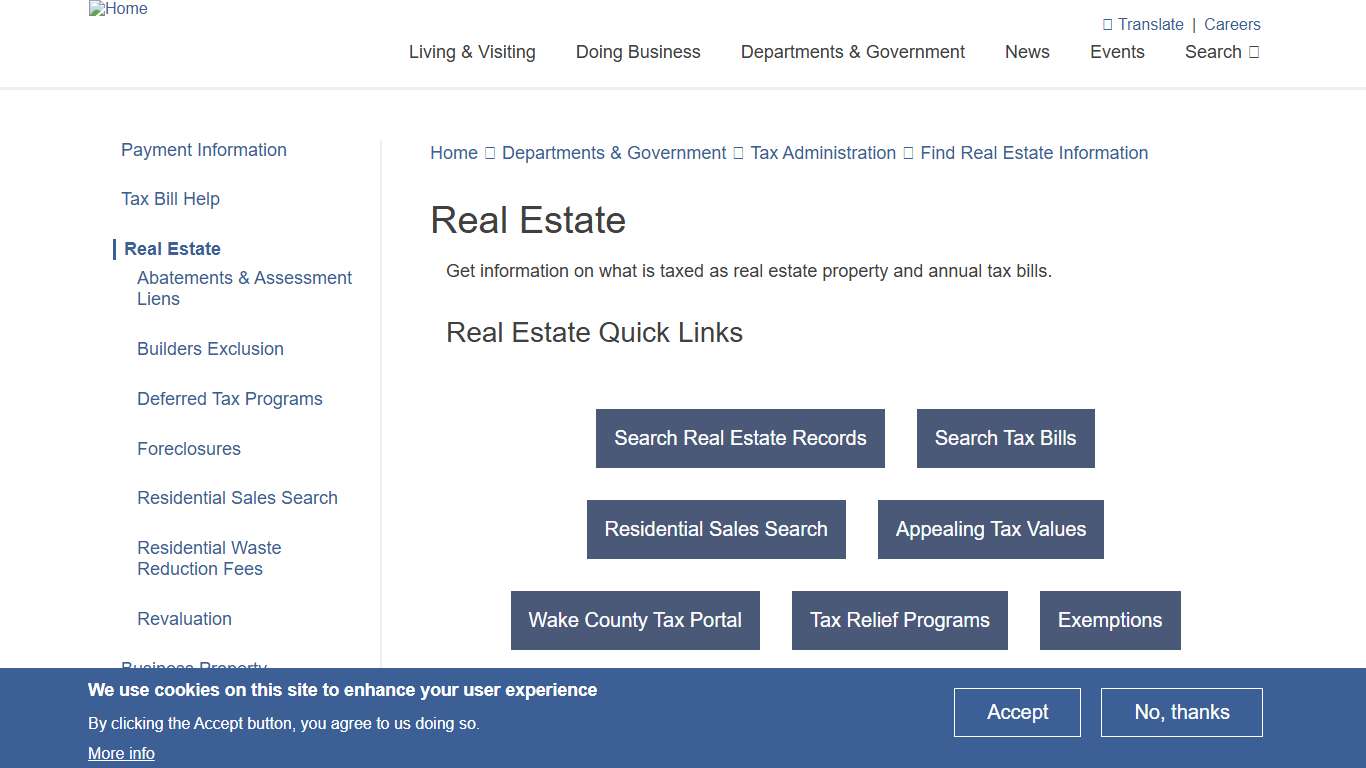

https://s3.us-west-1.amazonaws.com/wakegov.com.if-us-west-1/s3fs-public/documents/2025-12/2026%20Business%20Listing%20Instructions.pdfReal Estate Wake County Government

Get information on what is taxed as real estate property and annual tax bills. Real estate property includes: - Land - Buildings - Structures - Improvements - Permanent fixtures - Mobile homes that are placed upon a permanent enclosed foundation on land owned by the owner of the mobile home.

https://www.wake.gov/departments-government/tax-administration/real-estate

The Batch Brief (January 23, 2026): It’s not Property Tax relief — It’s a political cover-up.

The Batch Brief (January 23, 2026): It’s not Property Tax relief — It’s a political cover-up. Welcome to The Batch Brief! Hi Friends, As we head into a weekend of winter weather, I’m thinking a lot about what it means to look out for each other when things get tough.

https://batchbrief.substack.com/p/the-batch-brief-january-23-2026-itsProperty Tax - Forms NCDOR

A new tax on alternative nicotine products will also be imposed. Tax related to the rate change of product in inventory as of July 1 will apply. For more information, review the tobacco products page. The Department has issued a new notice titled, Eligibility for Listing in the North Carolina Department of Revenue Vapor Products and Consumable Products Directory.

https://www.ncdor.gov/taxes-forms/property-tax/property-tax-forms

Incentives Wake County Economic Development

We understand that a major barrier for companies looking to expand or relocate is cost; the cost of space, the cost of equipment, the cost of training employees. There are a number of ways organizations in our area can help your bottom line.

https://raleigh-wake.org/invest-expand-thrive/incentives

Incentives Wake County Economic Development

We understand that a major barrier for companies looking to expand or relocate is cost; the cost of space, the cost of equipment, the cost of training employees. There are a number of ways organizations in our area can help your bottom line.

https://raleigh-wake.org/invest-expand-thrive/incentives

Raleigh-Wake Hospitality Tax: An Intro Raleighnc.gov

How it works Why Tourism Matters in Raleigh Interlocal Projects That Enhance Our Community The Latest on City of Raleigh ILA Projects It's hard to write a business plan for a great moment. But a great city can foster those things.

https://raleighnc.gov/doing-business/services/raleigh-wake-hospitality-tax-intro

Assessments Town of Wake Forest, NC

The Town of Wake Forest, like all North Carolina local governments, has the authority to levy special assessments for certain improvements (i.e. - street improvements, sidewalks and nuisance abatements). A payment plan is typically established with the special assessments. In the event a property with a special assessment is sold, these assessments are generally paid at closing.

https://www.wakeforestnc.gov/finance/assessments

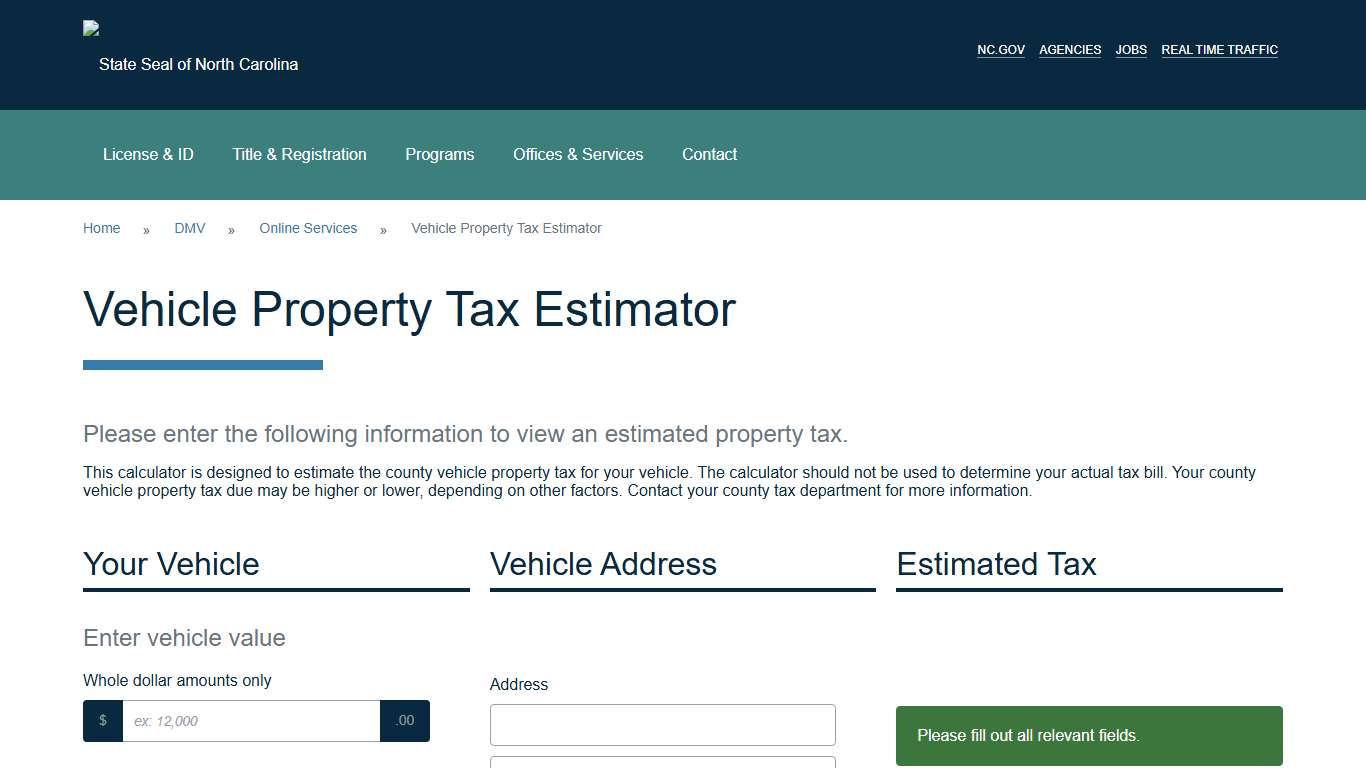

North Carolina Vehicle Property Tax Estimator

Please enter the following information to view an estimated property tax. This calculator is designed to estimate the county vehicle property tax for your vehicle. The calculator should not be used to determine your actual tax bill. Your county vehicle property tax due may be higher or lower, depending on other factors. Contact your county tax department for more information.

https://edmv.ncdot.gov/TaxEstimator